INTRODUCING TRUST

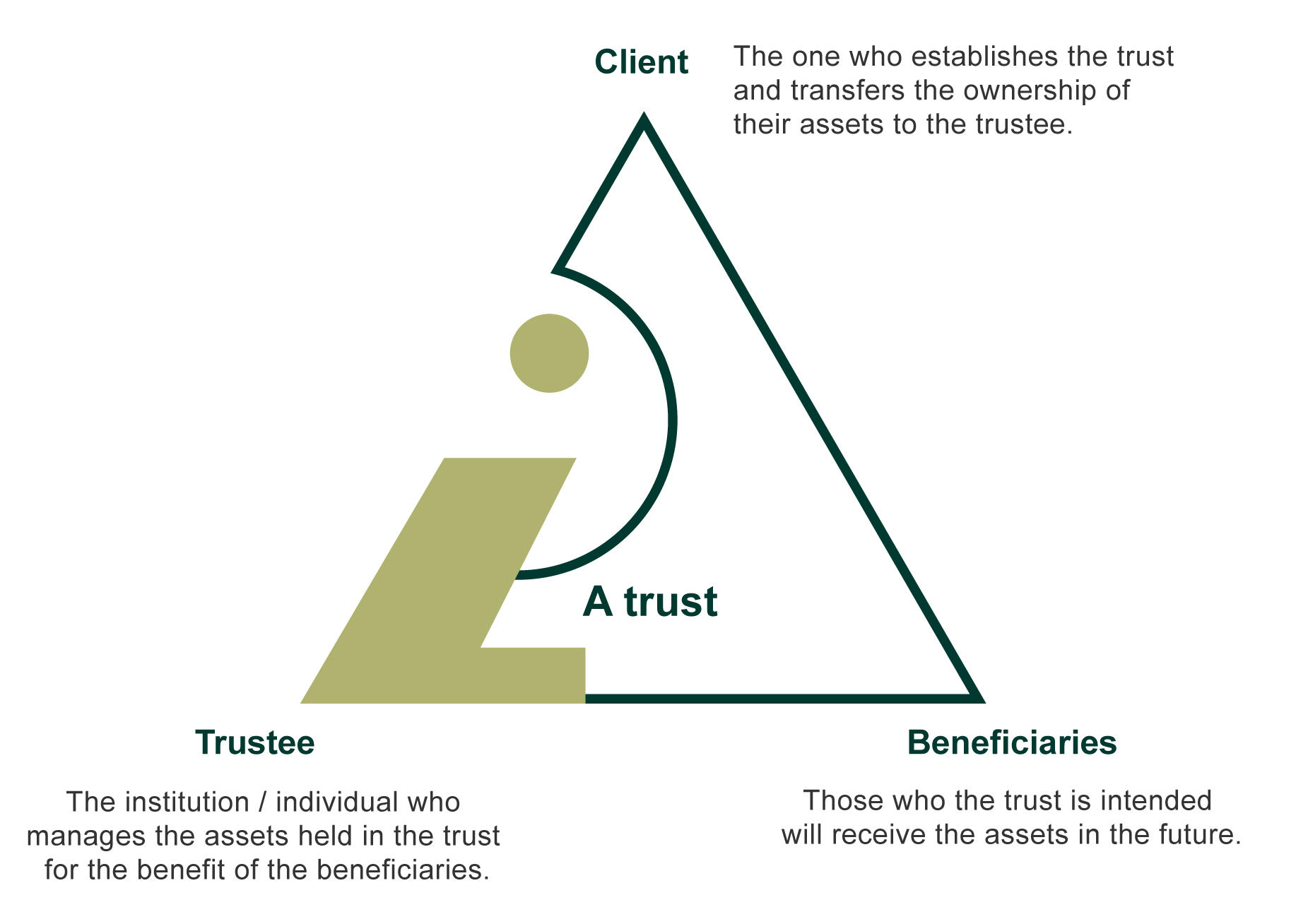

A trust is an arrangement involving three parties: the settlor, the trustee and the beneficiaries. The roles of the three can be represented by the trust triangle.

When a trust is created, the client must transfer the legal ownership of their trust assets to the trustee. The assets will become the property of the trust. The trustee then holds and manages the assets on behalf of the beneficiaries, in accordance with the terms and instructions outlined in the trust document. By establishing a trust, one may have their assets shielded from creditor or relationship property claims and avoid the time-consuming, costly and complicated probate procedures when passing assets to the intended beneficiaries.

Why the Cook Islands?

The Cook Islands, with the enhanced asset protection provisions contained in the International Trusts Act 1984 (“Act”), offers several distinctive advantages for offshore trust formation, in addition to the general benefits that trusts provide.

Trust Law

The Cook Islands trust law is derived from the Common Law which has been enhanced by the Act allowing trustees to better carry out their duty to preserve and protect trust assets.

Non-recognition of foreign judgements

A Cook Islands court will not recognise any judgement that is based upon any law inconsistent with the Act or relates to a matter governed by the law of the Cook Islands.

Protection from forced heirship and settlor's bankruptcy

No Cook Islands International Trust or any settlement on it, shall be void or voidable, in the event such trust or settlement may defeat the heirship rights of any person related to the settlor nor the settlor’s bankruptcy in his/her home jurisdiction.

Tax advantages

A Cook Islands International Trust is tax neutral in that it is not subject to any form of Cook Islands taxation.

Confidentiality of the trust structure

While each Cook Islands International Trust is registered by providing the registrar with the names of the trust and the trustee and the date the trust was established, there is no requirement to file the trust instrument or the names of the settlor or beneficiaries.

Protection for spendthrift beneficiaries

Any interest in trust assets given to a beneficiary during his/her lifetimes shall not be alienated or passed by bankruptcy, insolvency or liquidation or be seized or taken in execution by process of law.

Fraudulent claims

- Short time limit

A Cook Islands International Trust, or any settlement thereon, shall not be fraudulent against a creditor of the settlor if the settlement occurs either prior to the creditor’s cause of action arising or more than two years after it arose. If, however, the cause of action arises within two years of the settlement taking place, the creditor must bring an action in a court of competent jurisdiction within one year of the settlement.

- Burden of proof

The creditor shall only have access to the assets of the particular settlement being claimed and not the entire trust fund. He/She must bring an action within the time limits prescribed and prove beyond reasonable doubt that the particular settlement was made with the intention to defraud.